It is assumed that while importing goods in India, Import duty is too high that result in increasing cost of product abnormally. However this is far behind the truth. Please see this.

Customs Import Duty of phone under HS Code 85171290

| 85171290 : Telephones for cellular networks or Other | ||

|---|---|---|

| Description | Duty | |

| Basic Duty | 0.00 | |

| Education Cess | 2.00 | |

| Secondary Higher Education Cess | 1.00 | |

| Con-travailing Duty (CVD) | 10.00 | |

| Additional Con travailing Duty | 0.00 | |

| Additional Cess | 0.00 | |

| National Calamity Contingent Duty (NCCD) | 1.00 | |

| Abatement | 35.00 | |

| Total Duty | 11.43 | |

Here it should be noted that Educational cess i.e. 2% is not charged on product import price but on CVD, so net result come .2% increase in duty. Same goes for Abatement, Secondary Higher education Tax etc. So Total Import duty paid for iPhone, Or Samsung or Oppo or any phones in India is only 11.43%.

Also Read, iPhone Price in India

Different states charging VAT on Apple products as below.

| State | Sales Tax / Vat % |

| BIHAR | 5 |

| JHARKHAND | 5 |

| ORISSA | 13.5 |

| ASSAM | 14.5 |

| WEST BENGAL | 14.5 |

| GUJARAT | 15 |

| UTTARANCHAL | 5 |

| ANDRAPRADESH | 5 |

| GOA | 5 |

| KERALA | 5 |

| TAMILNADU | 5 |

| KARNATAKA | 5.5 |

| RAJASTHAN | 8 |

| HARYANA | 8.4 |

| DELHI | 12.5 |

| MAHARASHTRA | 12.5 |

| CG | 14 |

| MADHYA PRADESH | 14 |

| UTTAR PRADESH | 14.5 |

However it is not static and can be changed as per government in respective state. As this is complex structure so government of India is introducing GST to have uniformity all across India.

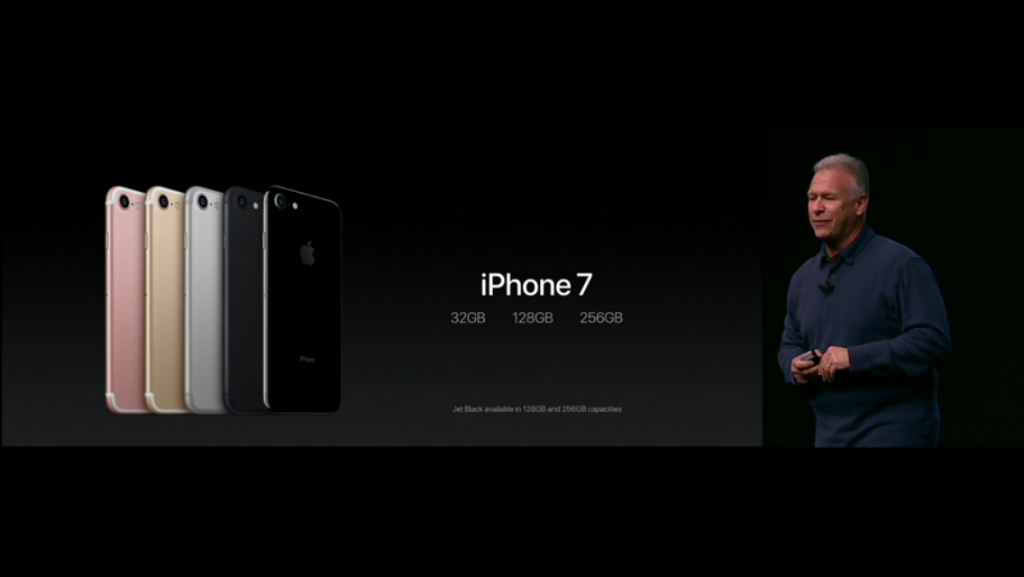

So it can be fairly put on record when iPhone 7 or 7 Plus is imported than import duty paid is only 11.43 % . Then on selling part, sales tax or VAT ( Value added tax) is paid and it varies state to state. Vat is minimum in India in states like Tamilnadu, Goa, Kerala, UK etc and highest in Gujarat, Assam, West Bengal, Uttar Pradeh, Madhya Pardesh etc.